Blockchain Bridges: Unlocking interoperability in Web3

May 16, 2023

Jan Hetleifš

The expansion of the web3 has brought about a remarkable transformation in the blockchain industry. However, it has also brought to light a significant obstacle: the ability for different blockchains to work together seamlessly.

Fortunately, the web3 community has recognized this problem and come up with a solution known as blockchain bridges

In this article, we'll explore the concept of blockchain bridges, their applications, and the potential risks associated with them.

What are blockchain bridges?

Blockchain bridges serve as a means of communication between separate blockchains, making it possible to smoothly transfer information and monetary assets from one chain to another.

These bridges play a vital role in enabling compatibility, allowing developers, investors, traders, and other individuals to engage with multiple chains.

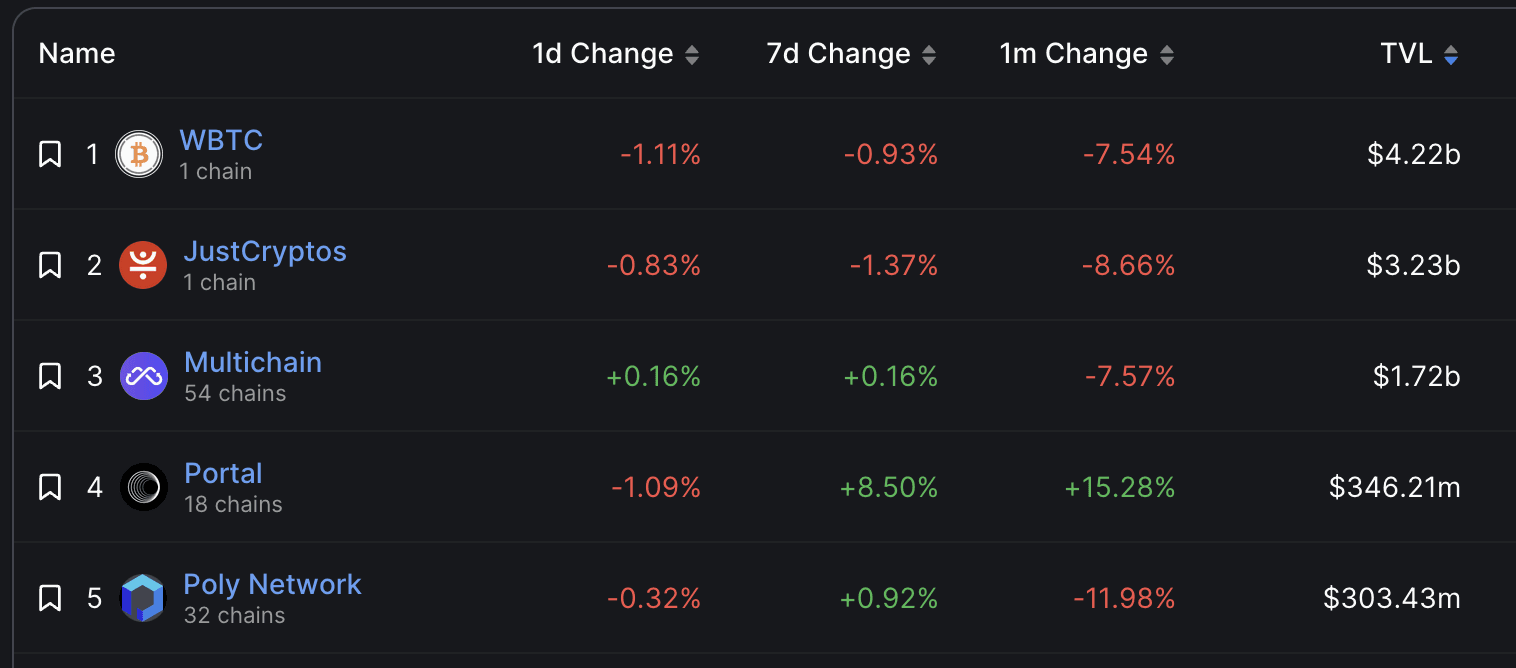

The significance of bridges has become increasingly evident in recent times, as demonstrated by the substantial amount of over $9 billion locked in just the top three bridges, as reported by Defi lama statistics.

How do blockchain bridges work?

Blockchain bridges work in a similar way to real-world bridges, acting as connectors between different blockchains.

They use advanced scripts and smart contracts, deployed on different chains, to facilitate the transfer of assets or data. Establishing trust between chains is a challenge, as the receiving chain views the incoming information as external data.

To overcome this, bridges act as verifiers or intermediaries, taking information from the source chain and logging it on the destination chain.

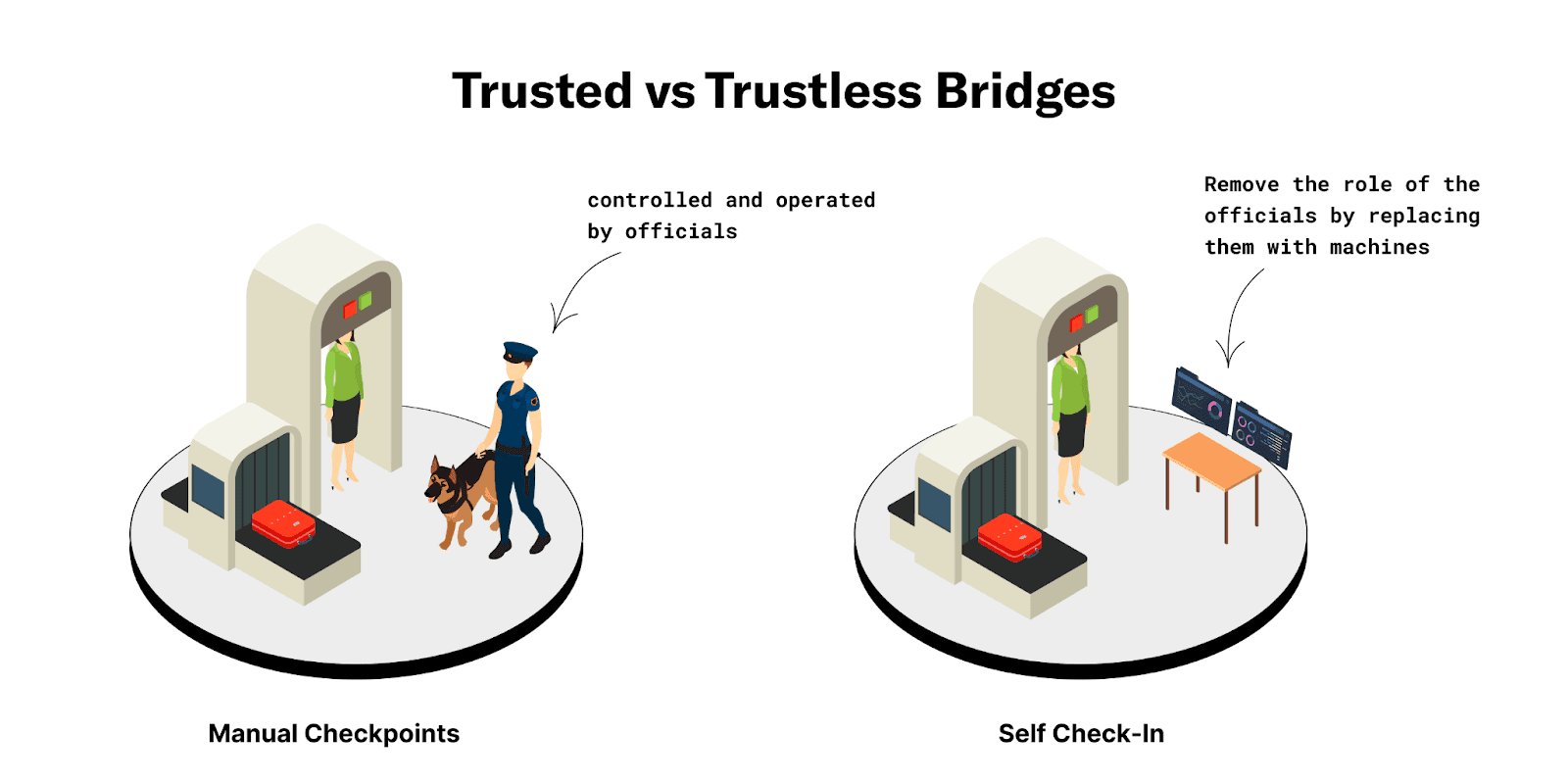

Bridges use different mechanisms, including both trustless and trust-based approaches, depending on their architecture.

Types of bridges based on how they work:

Source: https://li.fi/knowledge-hub/bridge-classification/

Trustless bridges: These bridges eliminate the need to trust a central authority, ensuring that the custody of tokens remains with the user during cross-chain transfers. Examples include Hop and Connext, which use atomic swap mechanisms.

Trust-based bridges: In contrast to trustless bridges, trust-based bridges involve a centralized authority taking control of user funds during cross-chain transfers. Examples include the Binance Ethereum Bridge and the Multichain Bridge.

Types of bridges based on the chains they connect:

L1 to L1 bridges: These bridges connect Layer 1 chains such as Ethereum, Solana, Avalanche and Algorand. The Wormhole Bridge connecting Ethereum and Solana is an example.

L1/L2 to L2 bridges: These bridges facilitate communication between Layer 1 and Layer 2 chains. The Arbitrum Bridge is an example, connecting Ethereum to the Arbitrum Layer 2 solution.

Types of bridges based on the movement of assets:

Bridges use different algorithms to move assets between chains:

Lock and Mint: This approach involves locking tokens on the source chain and simultaneously minting wrapped tokens on the destination chain. The Arbitrum Bridge uses this method.

Burn and Mint: Bridges such as Multichain use this approach, burning tokens on the source chain and minting equivalent tokens on the destination chain.

Benefits of blockchain bridges

Enabling Interoperability: Bridges provide users with the ability to transfer assets and data across different protocols and chains, thus promoting interoperability in the web3.

Access to different protocols: Users can use bridges to access a wide range of protocols on different chains, expanding their options and capabilities.

Interoperable dApps: Bridges allow decentralised applications (dApps) to achieve interoperability with other chains, enabling them to leverage different ecosystems and user bases.

Risks associated with blockchain bridges

While blockchain bridges offer tremendous benefits, they also pose risks and challenges. Some of the key risks include:

Security vulnerabilities: Many bridges have experienced security breaches, resulting in the loss of billions of dollars in assets. The smart contracts used by bridges can be vulnerable to bugs and attacks, making security a paramount concern. For example in the high-profile Wormhole hack over $300 million was stolen, as a result of vulnerabilities in the smart contracts.

Custodial risks: Another risk associated with cross-chain bridges is the potential loss of user funds due to liveness issues. If the custodians or validators responsible for validating cross-chain bridges neglect their duties or fail to maintain the bridges, this can lead to security compromises and delays.

There is still a lot of progress to be made in strengthening smart contracts and developing improved cross-chain bridges that facilitate communication between different blockchains.

The ultimate goal is to achieve complete trustlessness in cross-chain bridges, but this will be a gradual process.

It is clear that interoperability is the future of blockchain technology, and the industry is undoubtedly taking steps in the right direction.

Conclusion

Blockchain bridges are an important solution for achieving interoperability between different blockchains in the web3 space.

They enable the transfer of assets, data and even arbitrary messages across different protocols, allowing users to access different dApps and unlock new opportunities.

The three main benefits of blockchain bridges are a better user experience, improved asset productivity and increased liquidity for dApps.

Building successful

products.together.

© 2008—2023 Cleevio

Lesnicka 1802/11

613 00 Brno

Mississippi House

Karolinska 706/3

186 00 Prague

Prague office

Brno office

CIN 18008844