The World's First Omni-Custody Platform for Crypto Assets

Jul 12, 2023

Jan Hetfleiš

Cobo is leading the digital custody revolution. Trusted by over 500 institutional clients worldwide, they offer comprehensive custody solutions, including full, co-managed and decentralized self-custody options. With SOC 2 compliance and licences in key geographies, Cobo prioritizes security. Backed by top-tier investors, they are transforming the industry.

As proud partners of Cobo, we are delighted to bring you an exclusive interview.

Can you tell us a bit about yourself, your role at Cobo, and how you got involved in the blockchain industry?

My name is Arkady and I always wanted to build a career in traditional finance. However, after having such an opportunity, I came to realize that my interest lies in innovative technologies - such as blockchain. At Cobo, I work as part of the Business Development Team overseeing the Hong Kong and European markets.

Cobo in numbers

As one of the largest digital asset custodians globally, Cobo has gained significant traction in a short period. What sets Cobo apart from other providers in the industry?

Anyone can build and launch a wallet that can send and receive funds these days, but since the custody of digital assets involves the safekeeping of a company’s treasury funds, we aim for extremely high standards in security and efficiency.

Our industry-leading security standard is at the core of what we do and something that we pride ourselves by. We have a full team of seasoned security experts and we have had ZERO security incidents since we started in 2017.

Instead of focusing on only one custody technology, we are the world’s first and only omni-custody platform that offers the full spectrum of custody technologies from full custody to co-managed MPC custody to fully decentralized custody to cater to different use cases as well as user types. This enables us to tailor our solutions to each institution’s unique needs because custody is never one-size-fits-all.

Cobo offers a range of custody solutions, from full custody to co-managed custody. Could you explain these different approaches and help us understand how they cater to different needs?

Cobo provides a diverse range of custody solutions to meet different needs and preserences.

For institutions who want convenience and prefer to entrust the responsibility of key security to experts, Cobo offers Full Custody based on bank-grade hardware security modules (HSMs), intel SGX and a multi-layer defence mechanism. Some may prefer the convenience of doing so or simply do not have resources for a full security setup (physical security, employee security, cloud security etc).

For institutions who prefer maintaining control over the private keys and digital assets, Cobo offers cutting-edge Multi-Party Computation (MPC)-backed Co-Managed Custody that empowers users to be their own custodians.

We also offer Cobo Safe (smart-contract-based self-custody) that comes with rich functionalities, including role-based access controls, team collaboration tools, custom workflow support, and more, to support institutional DeFi teams to unlock their capabilities and seize opportunities in the world of decentralized finance.

Why did you decide to build Cobo's Wallet-as-a-Service solution? Could you elaborate on what it entails and how it benefits institutions?

Building a secure crypto wallet from scratch can be a complex and time-consuming process, requiring specialized knowledge and resources. In addition to the initial development costs, there are ongoing maintenance costs to consider - this can be very costly, especially for a startup - taking valuable time and resources away from other areas of the business.

We saw a growing demand for a customizable and scalable wallet infrastructure that institutions can integrate seamlessly into their existing systems. In response to this need, we decided to introduce Cobo Wallet-as-a-Service (WaaS), which is a standardized set of APIs and SDKs for developers to scale, manage and secure user wallets with minimal development effort and the associated costs.

One of the key benefits of our WaaS solution is its robust security infrastructure. Institutions can have peace of mind knowing that their own funds as well as user funds are safeguarded by a battle-tested and highly secure wallet infrastructure. Another advantage is our scalability and reliability. Offering institutions scalability of their operations without worrying about performance issues or downtime, ensuring a smooth user experience for their customers.

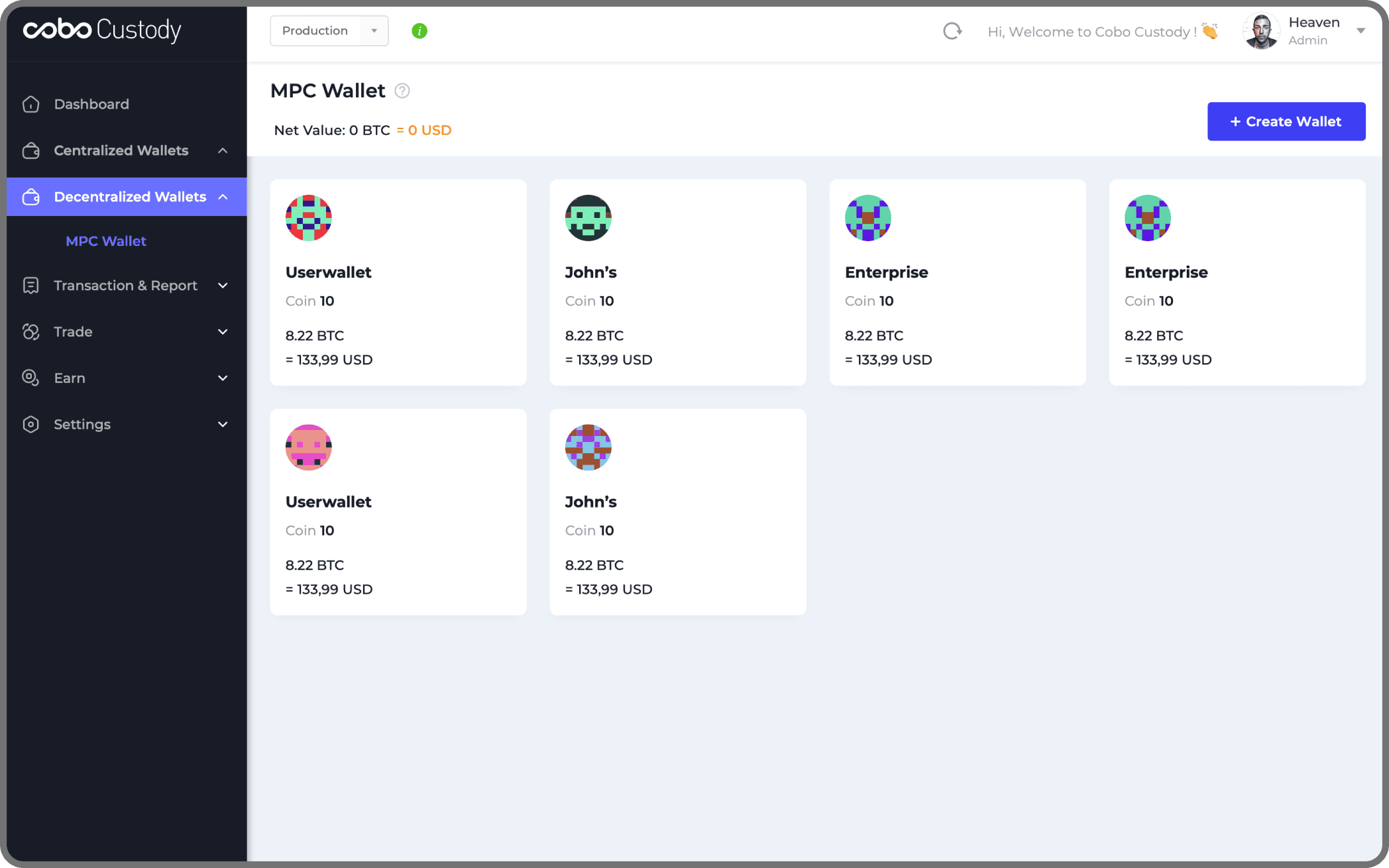

Cobo MPC WaaS

Security is a critical concern when it comes to digital asset custody. How does Cobo ensure the safety and integrity of the assets entrusted to them?

Cobo’s custody solutions are built on cutting-edge technologies to ensure the ultimate level of security for our users. One standout example is our MPC custody solution, which is built on state-of-the-art multi-party computation technology to eliminate the concept of a full private key, thereby mitigating the risk of a single point of failure. This effectively insulates user assets from internal and external attacks, as well as human errors.

Additionally, Cobo employs multiple layers of defence in our security infrastructure to effectively combat every attack vector and deliver the highest security to users. These security layers include a bank-grade HSM (Hardware Security Module) encryption machine, hardware isolation, a fully customizable policy engine to enable robust role-based access control and granular risk policies, zero trust architecture, Cobo Auth, offline key-shares distribution globally, and more.

Legally, customers are also protected by regulations in jurisdictions such as Hong Kong, where Cobo’s trust license and funds segregation ensure creditors cannot go after Cobo customers’ funds in extreme scenarios.

Regulatory compliance is a crucial aspect of the digital asset industry. How does Cobo ensure compliance with different regulations, especially in the jurisdictions where you are licensed?

Cobo is licensed globally in 5 jurisdictions including Hong Kong, Singapore, the US, Lithuania, and Dubai. Cobo has a dedicated in-house compliance team across different regions and has appointed experienced compliance officers to oversee the compliance of the relevant regulatory requirements. Specific to the compliance of AML/CFT requirements, Cobo makes use of third-party systems (e.g. Chainalysis) to conduct KYC and ongoing monitoring.

Cobo Custody benefits

Looking ahead, what can we expect from Cobo in terms of future innovations or expansions in the digital asset custody space?

One of our primary focuses is on the development of decentralized wallets that offer programmability, cost-efficiency, security, and user-friendliness. We recognize the importance of empowering users with greater control over their digital assets while ensuring the highest level of security. By leveraging advancements in blockchain technology such as account abstraction, Cobo's own research and development, as well as the development of generative AI, we aim to deliver enhanced decentralized wallet solutions to align with the fast-evolving needs of the digital asset custody space.

Furthermore, we are committed to responding swiftly to major events that impact our industry. As demonstrated in the launch of SuperLoop, our off-exchange settlement network, in the aftermath of FTX, we understand the importance of agility to better serve our community.

When you look back on working at Cobo, what do you consider to be the most notable accomplishment or milestone that you and your team helped to achieve?

Looking back, one of our most notable accomplishments was establishing Cobo as the world’s first omni-custody platform, which showcases our commitment to innovation, user-centricity, and meeting the evolving demands of the cryptocurrency ecosystem.

It positioned us as a trailblazer in the industry - allowing us to cater to the diverse needs of individual users, institutional clients, and enterprises, creating a one-stop solution that empowers users to securely navigate the world of digital assets.

Cobo winning the "Innovation in Digital Asset Custody Solutions" award

The blockchain industry has witnessed rapid growth and adoption in recent years. What excites you the most about the future of this industry, and how do you envision blockchain technology transforming various sectors in the future?

The rapid growth and adoption of the blockchain industry present a promising future filled with transformative potential, revolutionizing trust and transparency across various sectors. With growing blockchain, I see the need for secure and reliable storage solutions for digital assets becomes increasingly crucial.

In the future, I envision blockchain technology transforming the way we approach custody across various sectors. Traditional custodial services, burdened by centralized structures, have inherent risks and limitations. However, with blockchain, we have the opportunity to redefine custody by introducing decentralized and trustless solutions.

Digital asset custody solutions, like those provided by Cobo, enable individuals to retain full control over their private keys and funds while benefiting from enhanced security measures.

Building successful

products.together.

© 2008—2023 Cleevio

Lesnicka 1802/11

613 00 Brno

Mississippi House

Karolinska 706/3

186 00 Prague

Prague office

Brno office

CIN 18008844