Key Takeaways From the State of European Crypto Startups 2023 Report

Mar 28, 2023

Jan Hetfleiš

RockawayX, the leading crypto & web3 investment firm, and Dealroom.co, the global startup & venture capital intelligence platform, have produced a State of European Crypto Startups report, which looks at the European state of crypto startups compared to the global market over the past few years. They found interesting trends in investment and we summarised them for you.

Takeaways

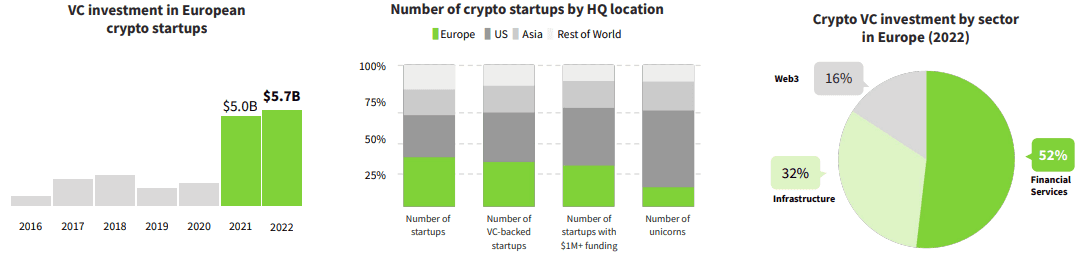

Looking from the top, the data shows that the total amount of VC funding in European crypto grew by 14% in 2022, with a total investment of $5.7 billion, and European companies accounted for 20% of total global early-stage startup funding. And while Europe has the largest number of crypto startups, the US still leads in the number of unicorns created.

Source: State of European Crypto Startups report by RockawayX and Dealroom.co

Speaking of unicorns, their creation reached a global peak in 2021. The most notable unicorns created in Europe are Blockchain.com (crypto trending), Bitpanda (crypto broker), Sorare (Web3 gaming / NFT), Copper (institutional crypto custody) and Ledger (hardware wallet).

It's also interesting to note that in 2022, 52% of funding went to companies developing financial products and services, 32% to blockchain infrastructure and the remaining 16% to other Web3 startups. The report also highlights that within crypto financial services, CeFi (centralized finance) companies continue to attract the most funding and DeFi (decentralized finance) projects managed to narrow the funding gap in 2022, growing by 120% year-on-year to reach $1.2 billion in investment. This demonstrates the growing interest in DeFi and the potential for this sector to disrupt traditional financial services.

The report also highlights the growing investment in blockchain infrastructure, led by layer 1s and developer tools. According to the report, funding for blockchain infrastructure is on the rise, with total investment expected to reach $1.8 billion by 2022.

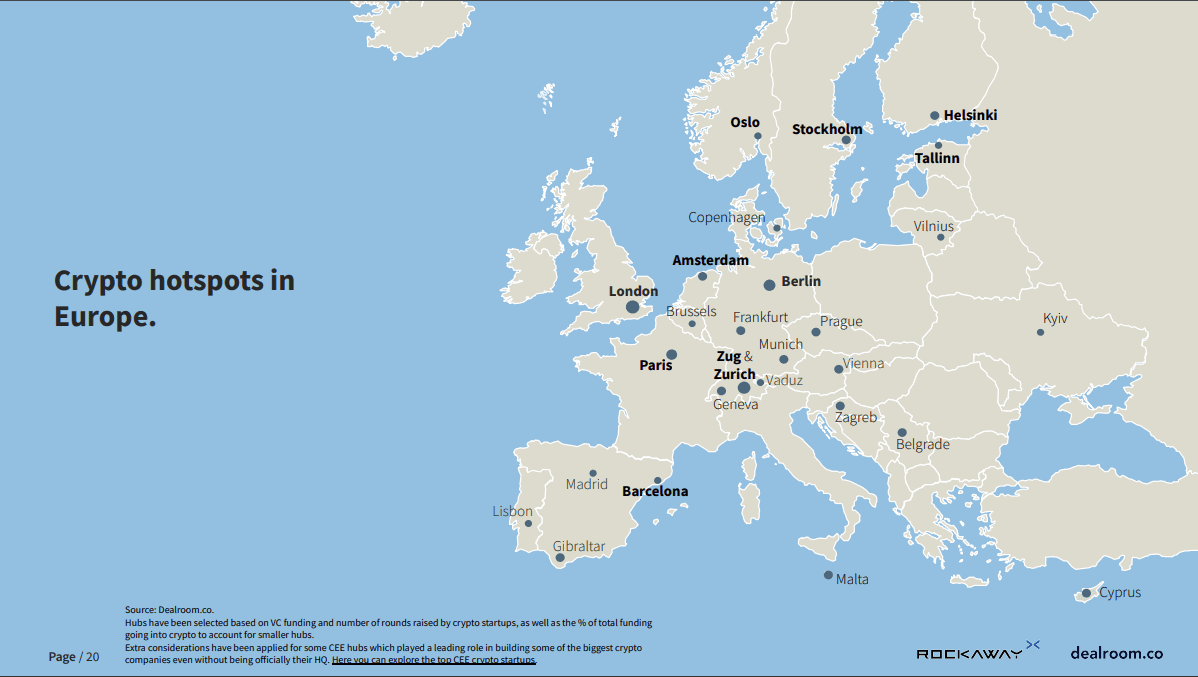

The report also talks about the crypto hubs of Europe. London leads, followed by the fast-emerging Swiss cities of Zug and Zurich, which grew 123% in crypto startup investment. Berlin came third and Paris fourth, while other emerging crypto hotspots include Stockholm, Tallinn and Barcelona.

Source: State of European Crypto Startups report by RockawayX and Dealroom.co

Regulation of crypto startups

The report also mentions regulation as a key issue for crypto startups. New regulations are being developed in Europe that will set a global standard and address various aspects of crypto-assets, including the offering and marketing of crypto-assets, the issuance of asset-referenced tokens and e-money tokens (stablecoins), the authorisation and operating conditions for crypto-asset service providers, the prevention of market abuse involving crypto-assets, and the role of competent authorities.

The regulation will be implemented by:

Regulation of Markets in Crypto Assets (MiCA)

Transfer of Funds Regulation (TFR)

Digital Operational Resilience Regulation (DORA)

DLT Pilot

Anti-Money Laundering Regulation (AMLR)

The report identifies MiCA as the most significant of these regulations, with 126 articles and more than 350 pages covering a wide range of new European rules. The expected timeline for application is Q1 2023 for publication in the EU Official Journal, and Q1 2024 for application of stablecoin rules / Q3 2024 for other rules.

Although new regulations may provide legal certainty for crypto asset service providers and stablecoin issuers, they may also pose challenges for crypto startups. Compliance with new regulations may be costly and time-consuming for startups, making it difficult for them to compete with established players.

Overall, the report paints a positive picture of the European crypto market and demonstrates the growing interest and investment in the sector. As the industry grows, we can expect to see more investors and companies entering the market and continued growth and innovation in the European crypto space.

To get the full picture, download the report. All credits go to RockawayX and Dealroom.co.

Building successful

products.together.

© 2008—2023 Cleevio

Lesnicka 1802/11

613 00 Brno

Mississippi House

Karolinska 706/3

186 00 Prague

Prague office

Brno office

CIN 18008844