Must Haves for Web3 Projects to Attract VC Investments

Aug 21, 2023

Jan Hetfleiš

Welcome to our article on the essential components that web3 projects need to have in place to attract venture capital (VC) investments. As the web3 ecosystem continues to grow and evolve, VCs are increasingly looking for innovative projects that have the potential for significant returns on investment.

To have a chance with VCs, web3 projects must demonstrate a clear value proposition, a strong team and advisors, a demonstrable product or prototype, market potential and scalability, a solid business model and monetization strategy, and a competitive advantage. In the following sections, we will delve into these must-haves in detail, exploring why each component is critical for web3 projects seeking funding from VCs.

Are you looking for investment? We can help.

Clear Value Proposition

A clear and compelling value proposition is crucial for web3 projects seeking venture capital investments. Your value proposition must clearly communicate how your project solves a real problem and offers unique value in the web3 ecosystem. By highlighting the benefits and potential impact your project can have, you will capture the attention of potential investors.

Make sure to focus on the specific pain points your project addresses, differentiate it from competitors, and explain why it is unique. Demonstrate how your project has the potential to create significant value for users and stakeholders in the web3 ecosystem.

Strong Team and Advisors

Having a strong, diverse team with relevant experience in the web3 space is crucial for attracting VC investments. Your team should have a clear understanding of the web3 ecosystem and the challenges and opportunities it presents. It's important to showcase your team's skills and experience, highlighting how they will contribute to the success of your project.

Additionally, having reputable advisors can add credibility and expertise to your project. Advisors with a strong network and experience in your industry can provide valuable guidance and connections. Make sure to highlight the relevant experience and expertise of your advisors.

Demonstrable Product or Prototype

One of the most important factors that could help web3 projects attract VC investments is having a demonstrable product or prototype. As VCs are looking for tangible progress and proof of concept, having an actual product or prototype that showcases the capabilities of your web3 project is crucial.

By presenting a product or prototype, you provide investors with evidence that you have made progress. This helps to reduce the perceived risk for investors and demonstrates that you have a real project that solves a problem or fills a gap within the web3 ecosystem. Additionally, having a product or prototype helps investors better visualize the project and its potential impact.

It is important to note that a product or prototype doesn't have to be a finished or fully functioning product. However, it should be able to demonstrate the unique features and functionalities of your project and how it can benefit end-users. This will help investors understand the potential of your project and its competitive position within the web3 space.

Market Potential and Scalability

VCs are interested in investing in projects that have a large market potential and the ability to scale. To demonstrate this, you need to conduct thorough market research and provide detailed strategies for growth and scalability. By doing so, you can convince potential investors that your project has the potential to generate significant returns on investment.

When conducting your market research, you should consider the size of your target market and the demand for your product or service. You should also analyze your competitors and identify any unique features or advantages that you have over them. This will help you to develop a solid strategy for growth and demonstrate to investors that your project has a competitive edge.

By highlighting the market potential and scalability of your web3 project, you can increase your chances of attracting VC investments. In the next section, we will look at the importance of having a solid business model and monetization strategy.

Solid Business Model and Monetization Strategy

A solid business model and monetization strategy are key components of attracting VC investments in your web3 project. It's important to have a clear understanding of how your project will generate revenue and be profitable in the long term.

Outline your revenue streams and how they will be generated. Consider offering multiple revenue streams, such as transaction fees, subscription services, or advertising. Highlight any unique aspects of your business model that set it apart from competitors.

It's also important to have a well-defined monetization strategy. Explain how you plan to monetize your web3 project without compromising user experience or decentralization. Consider factors such as token economics and value capture mechanisms.

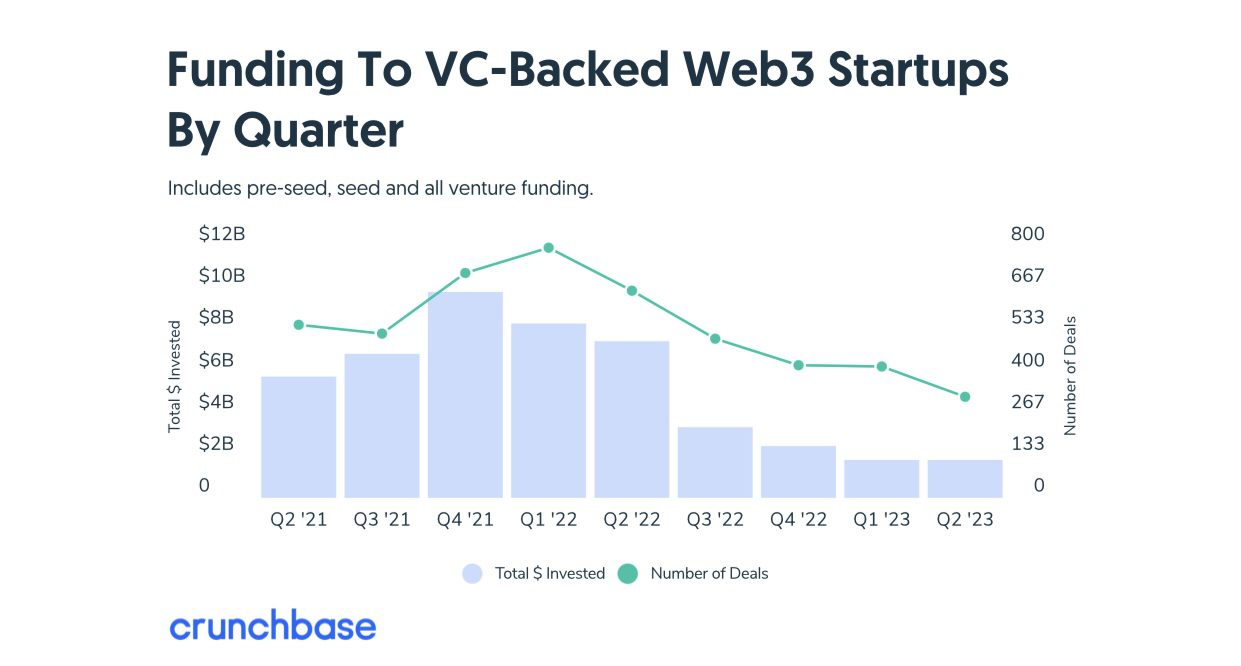

VC investments are slowing down. VCs are paying more attention to startups with proof of profitability and attractive economics. Source: https://www.crunchbase.com/

Competitive Advantage and Differentiation

In the highly competitive web3 space, it is essential for projects to have a clear competitive advantage and strong differentiation from existing solutions. Investors want to see what sets your project apart and why it has the potential for long-term success.

One way to demonstrate your project's competitive advantage is by highlighting any unique features, technology, or partnerships that give it an edge over competitors. For example, if your project has a novel consensus mechanism or a strategic partnership with a leading blockchain company, be sure to showcase these strengths.

Differentiation is also key in capturing the attention of investors. Clearly communicate how your project is addressing a real problem in the web3 ecosystem, and how it stands out from other solutions on the market. This can be achieved through a strong value proposition, user-friendly design, or a focus on a specific niche within the web3 space.

Insights from Token Ventures

From our perspective of investment company, not being a VC per se, we always do our proper due diligence before considering an investment in web3 project. However, every time there's something additional that helps decide. One of the things is project's team related. It is how well a potential investment partner gets on the same wavelength with founders, especially with the leader.

Another aspect is the ability of a project to set a proper valuation. It naturally differs under bull or bear market conditions, because with fluctuating activity come over/underestimations, which can eventually become a double-edged sword. This means that if a project was raising during a bull market with an exaggerated valuation, it’s much harder to go for another raise round with such a valuation during bear market. Then the down-to-earth effect hits harder. Many teams experience problems to deal with it.

In the end, a timely and sound understanding of striking the balance can decide a lot.

One more thing is founders’ ability to think about good timing for both market entry and fundraising. If the team finds the best possible window of time to joint these two things together, it will have a desired effect. Therefore, it has to do with objective evaluation of the market as well as project valuation, and future thinking in case of further funding. It may sound cliché, but stick to the infamous thought: "bull market is for raising and bear market is for building".

Overall, a web3 project going for fundraising should go with a compact package to persuade the investors. Only then are the chances for success higher if all those components fit together.

Check Token Ventures website and X (Twitter).

Conclusion

To attract VC investments, web3 projects must have a clear and compelling value proposition, a strong and diverse team with reputable advisors, a demonstrable product or prototype, a large market potential with scalability strategies, a well-defined business model with monetization strategies, and a competitive advantage that differentiates itself from existing solutions.

By focusing on these must-haves, web3 projects can increase their chances of success in the evolving web3 ecosystem. It is important to showcase these elements when seeking funding from venture capitalists, as they will play a crucial role in determining the level of investment.

Remember, VCs are looking for projects with significant potential for returns on their investment. By showcasing a clear vision, a solid team, and a tangible prototype, web3 projects stand a better chance of capturing the attention and funding of VCs.

At Cleevio we are passionate about turning ideas into reality. We offer support in fundraising, discovery, development and growth strategies.

We also offer the option to take equity as part of our compensation. It's our way of showing commitment and delivering exceptional results. Get in touch with us for more details.

Building successful

products.together.

© 2008—2023 Cleevio

Lesnicka 1802/11

613 00 Brno

Mississippi House

Karolinska 706/3

186 00 Prague

Prague office

Brno office

CIN 18008844